Small business proprietors wear several hats. From taking care of daily operations to intending long-lasting growth, every decision impacts the success of the business. Among the most vital choices is picking the appropriate financial institution. While conventional financial institutions might look like the default alternative, lending institution use an effective option that numerous small businesses forget.

Unlike big financial institutions, cooperative credit union operate with a member-first approach, which can cause lower charges, customized solution, and better monetary solutions. Comprehending how a cooperative credit union can sustain your company can be the trick to financial stability and success.

The Credit Union Advantage for Small Businesses

Local business flourish on partnerships, and cooperative credit union succeed at fostering individual links with their participants. Unlike big banks, lending institution focus on their local neighborhoods, meaning business proprietors obtain a more tailored technique to economic solutions. This individual touch guarantees that services aren't simply numbers-- they're valued participants with one-of-a-kind demands and objectives.

In addition, credit unions are not-for-profit organizations, which implies they reinvest their incomes into much better rates, lower fees, and improved financial solutions. This framework straight profits company owner that need affordable financial solutions to grow and maintain their procedures.

Competitive Lending Options for Small Businesses

Access to funding is a leading priority for entrepreneur, and credit unions use a selection of financing alternatives created to meet the demands of expanding firms. Whether you require working capital, funds for equipment, or a development strategy, credit unions give versatile terms and competitive rates of interest.

Unlike standard banks that often have stiff lending plans, credit unions put in the time to comprehend your organization. Their lending requirements frequently consider your organization history, future possibility, and relationship with the organization. This can be a game-changer for businesses that struggle to protect financing elsewhere. Furthermore, business owners who require assistance in their individual finances can likewise discover personal loans, which might provide added financial adaptability.

Modern Banking with a Personal Touch

Running a small company calls for efficient and accessible financial services. Lending institution have accepted electronic change, supplying convenient online banking solutions that equal those of larger banks. From managing accounts to refining transactions and moving funds, company owner can handle their financial resources perfectly from anywhere.

Yet what sets lending institution apart is their ability to mix technology with phenomenal customer support. While large banks commonly depend on automated systems and chatbots, lending institution prioritize human interaction. If a problem occurs, local business owner can speak directly with a genuine individual who comprehends their certain scenario and can offer customized options.

Secure Savings and Competitive Interest Rates

Conserving cash is crucial for service durability, and lending institution offer various cost details savings choices that assist services construct economic gets. A money market account is a fantastic tool for organizations that want to make affordable passion while maintaining access to their funds. With higher rates of interest than common savings accounts, this option enables services to expand their cash while maintaining liquidity.

In addition, credit unions provide lower fees on checking accounts, which means businesses can maximize their profits without stressing over extreme fees. These little however impactful benefits make a considerable difference in long-term financial preparation.

Affordable Business and Vehicle Financing

For organizations that rely on vehicles for distributions, transport, or customer check outs, having the ideal financing options is essential. Credit unions supply affordable auto loans that can help small company owners financing business cars with lower rates of interest and flexible repayment strategies.

Unlike traditional financial institutions that might have rigorous borrowing needs, lending institution deal with members to find financing solutions that match their demands. Whether buying a single vehicle or an entire fleet, entrepreneur can benefit from cost effective car loan terms that support their operations.

A Partner for Growth and Success

Beyond economic products, credit unions play an energetic function in supporting neighborhood services through education and learning, networking chances, and community interaction. Numerous lending institution use financial proficiency programs, workshops, and one-on-one consulting to aid entrepreneur make educated financial choices.

Being part of a lending institution also suggests belonging to an area that genuinely appreciates your success. This link cultivates an environment where businesses can work together, get insights, and utilize sources that could not be readily available through larger financial institutions.

Experience the Credit Union Difference

Choosing the best banks is a critical step for small business proprietors. Lending institution provide an unique mix of reduced fees, personalized solution, and affordable financial products that assist services grow. Whether you're looking for business funding, a trusted money market account, or accessible online banking, a credit union could be the ideal monetary companion for your company.

If you're all set to explore just how a lending institution can sustain your small business, stay tuned for more understandings and updates. Follow our blog for the most up to date pointers on business financial, monetary monitoring, and development techniques customized to small company proprietors like you. Your success begins with the best monetary foundation-- uncover the lending institution benefit today!

Patrick Renna Then & Now!

Patrick Renna Then & Now! Hailie Jade Scott Mathers Then & Now!

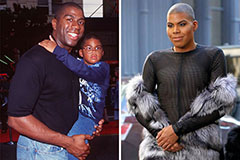

Hailie Jade Scott Mathers Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!